BlockWealth Lite is the perfect way to start investing in cryptocurrency and blockchain. You invest in a convenient way in fifteen different cryptocurrencies.

The fifteen cryptocurrencies are selected on basis of market capitalization. BlockWealth Lite is therefore an investment in the index of the top fifteen most valuable cryptocurrencies.

BlockWealth Lite is available from €2,500.

BlockWealth Lite is the perfect way to start investing in cryptocurrency and blockchain. You invest in a convenient way in fifteen different cryptocurrencies.

The fifteen cryptocurrencies are selected on basis of market capitalization. BlockWealth Lite is therefore an investment in the index of the top fifteen most valuable cryptocurrencies.

BlockWealth is available from €2,500.

BlockWealth Lite portfolio

BlockWealth Lite Portfolio

Allocation

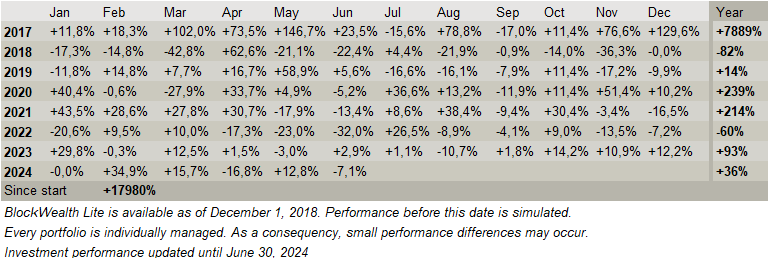

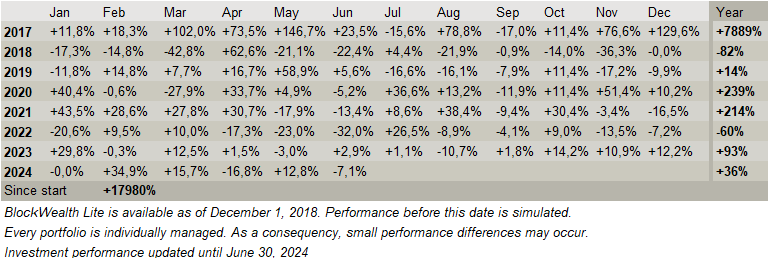

Performance BlockWealth Lite

The graph shows the performance for the BlockWealth Lite portfolio starting at January 1, 2017.

Track Record BlockWealth Lite

Performance

The graph shows the performance for the BlockWealth Lite portfolio starting at January 1, 2017.

Track Record BlockWealth Lite

Composition and diversification

The fifteen cryptocurrencies in BlockWealth Lite are selected by the use of the index that is composed by BlockBay Capital. The index is semi-annually composed by the use of the top fifteen most valuable cryptocurrencies on CoinMarketCap CoinMarketCap. The index is composed by design of the following two rules.

Rule #1 – Market capitalization

The market capitalization indicates the value of a specific cryptocurrency according to the market. The market capitalization of a cryptocurrency is calculated by multiplying the supply with the price. If, for example, the market capitalization of Bitcoin is 0 billion and the market capitalization of Ethereum is billion, all Bitcoins together are (according to the market) five times as valuable as Ethereum.

BlockWealth Lite invests in the fifteen most valuable cryptocurrencies, determined by market capitalization.

Rule #2 – Diversification

BlockWealth Lite invests in fifteen cryptocurrencies. That number is chosen after quantitative research (in Dutch) shows that de ideal range of cryptocurrencies to invest in, is between fourteen and twenty-two. Investing in the fifteen highest ranked cryptocurrencies ensures that the portfolio is automatically invested in the most valuable cryptocurrencies.

There is a limitation in BlockWealth Lite that a specific cryptocurrency can not account for more than 30% of the total. This ensures specifically that Bitcoin is not heavily weighted and leads to a better diversification as a result.

BlockWealth Lite uses the following three additional rules to promote diversification.

Rule #2.1 – Maximum cap of 30% per cryptocurrency

A cryptocurrency can have a maximum weight of 30% in the BlockWealth Lite portfolio. This ensures specifically that Bitcoin is not extremely overweighted.

Rule #2.2 – Maximum two stablecoins

Stablecoins are cryptocurrencies that are designed to have minimal price volatility. Stablecoins are pegged to fiat currencies (such as the US Dollar or Euro). BlockWealth Lite consists of maximum two stablecoins to prevent the portfolio from being to correlated to fiat currencies. If the top fifteen cryptocurrencies consists of (for example) three cryptocurrencies, the lowest ranked stablecoin will be excluded from BlockWealth Lite and the number sixteen of CoinMarketCap will be included in BlockWealth Lite.

Rule #2.3 – Availability

If a crypto coin from the top 15 is not available on the platform that is used for the management of the portfolio, the next crypto coin outside the top 15 is purchased.

Rebalancing and adjustments in BlockWealth Lite

The cryptocurrency portfolio is semi-annually adjusted according to the defined rules. This means that the weights are semi-annually determined by using the market capitalization of the end of the half year. Possible adjustments in the top fifteen cryptocurrencies are also accounted for. Portfolio adjustments are made in the beginning of a new half year.

Do you start investing in BlockWealth Lite during the half year? The cryptocurrencies in the portfolio are determined by using the allocation as of the previous end of the half year, the weights are based on current market values.

Composition and diversification

The fifteen cryptocurrencies in BlockWealth Lite are selected by the use of the index that is composed by BlockBay Capital. The index is semi-annually composed by the use of the top fifteen most valuable cryptocurrencies on CoinMarketCap CoinMarketCap. The index is composed by design of the following two rules.

Rule #1 – Market capitalization

The market capitalization indicates the value of a specific cryptocurrency according to the market. The market capitalization of a cryptocurrency is calculated by multiplying the supply with the price. If, for example, the market capitalization of Bitcoin is 0 billion and the market capitalization of Ethereum is billion, all Bitcoins together are (according to the market) five times as valuable as Ethereum.

BlockWealth Lite invests in the fifteen most valuable cryptocurrencies, determined by market capitalization.

Rule #2 – Diversification

BlockWealth Lite invests in fifteen cryptocurrencies. That number is chosen after quantitative research (in Dutch) shows that de ideal range of cryptocurrencies to invest in, is between fourteen and twenty-two. Investing in the fifteen highest ranked cryptocurrencies ensures that the portfolio is automatically invested in the most valuable cryptocurrencies.

There is a limitation in BlockWealth Lite that a specific cryptocurrency can not account for more than 30% of the total. This ensures specifically that Bitcoin is not heavily weighted and leads to a better diversification as a result.

BlockWealth Lite uses the following two additional rules to promote diversification.

Rule #2.1 – Maximum cap of 30% per cryptocurrency

A cryptocurrency can have a maximum weight of 30% in the BlockWealth Lite portfolio. This ensures specifically that Bitcoin is not extremely overweighted.

Rule #2.2 – Maximum two stablecoins

Stablecoins are cryptocurrencies that are designed to have minimal price volatility. Stablecoins are pegged to fiat currencies (such as the US Dollar or Euro). BlockWealth Lite consists of maximum two stablecoins to prevent the portfolio from being to correlated to fiat currencies. If the top fifteen cryptocurrencies consists of (for example) three cryptocurrencies, the lowest ranked stablecoin will be excluded from BlockWealth Lite and the number sixteen of CoinMarketCap will be included in BlockWealth Lite.

Rule #2.3 – Availability

If a crypto coin from the top 15 is not available on the platform that is used for the management of the portfolio, the next crypto coin outside the top 15 is purchased.

Rebalancing and adjustments in BlockWealth Lite

The cryptocurrency portfolio is semi-annually adjusted according to the defined rules. This means that the weights are semi-annually determined by using the market capitalization of the end of the half year. Possible adjustments in the top fifteen cryptocurrencies are also accounted for. Portfolio adjustments are made in the beginning of a new hal fyear.

Do you start investing in BlockWealth Lite during the half year? The cryptocurrencies in the portfolio are determined by using the allocation as of the previous end of the half year, the weights are based on current market values.

Invest in BlockWealth Lite?

Leave your information and we will contact you.